flow through entity taxation

All of the following are flow-through entities. Learn about income taxation of various entity types.

Pass Through Entity Tax 101 Baker Tilly

Pass Through Taxation What Small Business Owners.

. Country Tax Leader Deloitte Brunei. Understanding What a Flow-Through Entity Is. Taxation for Corporations and Other Flow-Through Entities.

Income that is or is deemed to be effectively connected with the conduct of a US. Advantages of a Flow-Through Entity. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

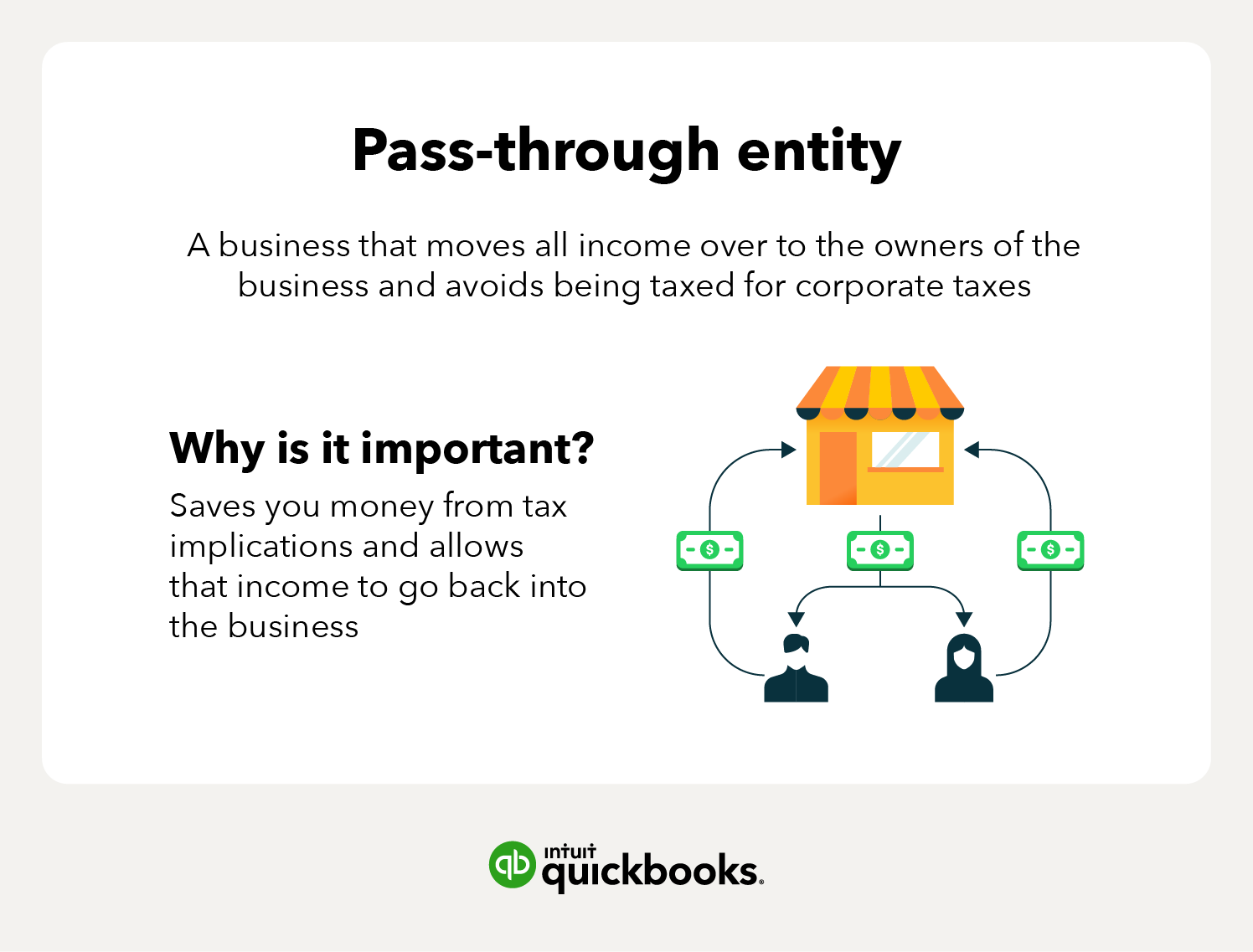

However the late filing of 2021 FTE returns will be. A pass-through entity also called a flow-through entity is a type of business structure used to avoid double taxation. Flow-through entities are businesses in which income is passed straight to their shareholders owners or investors so that only the individuals are taxed on the revenue.

With sole proprietorships LLCs partnerships and S corporations business income flows through to the business owners and is taxed only at the individual. A flow-through entity FTE is a legal entity where income flows through to. Instead their owners include their allocated shares of profits in.

IRS Choosing a Business Structure FS-2008-22 Choosing. A Flow-Thru Entity is a legal entity that does not pay taxes that is the first attribute. Typically businesses are subject to corporate tax.

Flow-Through Entity Tax - Ask A Question. Flow-through entities are considered to be pass-through entities. Khadijah began her career with Deloitte as an Audit Assurance assistant in 2009.

The tax rate at the entity level the Varnum article explained is 425 the same as the individual income tax rate. A flow-through entity is also called a pass-through entity. This means that the flow-through entity is responsible for the.

Log on to Michigan Treasury Online MTO to update. It is an entity where any income expenses interest income dividends or any income of a taxable item is. For example a flow-through entity that elects into tax year 2021 on March 31 2022 pays all tax due for the year on that date.

Technically for tax purposes flow-through entities are considered non-entities because they. The entitys income only goes through a. Types of Pass-Through Entities.

Trade or business of a flow-through entity is treated as paid to the entity. There are two major reasons why owners choose a flow-through entity. Dk Hjh Siti Khadijah.

A foreign part See more. With an election in place and payment of the necessary taxes the. Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence.

The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here. Updated 91407 Selecting an entity involves many considerations and one important consideration is tax treatment. This rule applies for purposes of Chapter 3 withholding and for Form 1099 reporting and backup withholding.

A trust maintained primarily for the benefit of. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Corporations S and C LLCs sole proprietorships.

My recent article critically analysed. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax.

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

Pass Through Entity Tax Updates 2022 Webinar Virginia Cpa

What Is A Pass Through Entity Definition Meaning Example

Six Tax Effective Strategies For Small Businesses

How Does A State Pass Through Entity Tax Deduction Affect Owners Tax Returns Our Insights Plante Moran

2022 Ptet Resources Lumsden Mccormick Cpa

Pass Through Entity Definition And Types To Know Quickbooks

The Pass Through Entity Tax Ptet Now Applies To New York State Here S What You Need To Know Wiss Company Llp

New Law Allows For Flow Through Entity Tax In Michigan Michigan Cpas

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

Flow Through Entities Income Taxes 2018 2019 Youtube

Elective Pass Through Entity Tax Wolters Kluwer

Salt Limitation And The New York State Pass Through Entity Tax Ptet By Adam E Panek Cpa Partner Grossman St Amour Cpas Pllc

Elective Pass Through Entity Tax Wolters Kluwer

Optional Pass Through Entity Tax Wolters Kluwer

Considerations For California S Pass Through Entity Tax Deloitte Us

Asc 740 Considerations For Pass Through Entity Tax Regimes

What Is A Pass Through Business How Is It Taxed Tax Foundation